The “new-norm” in the age of COVID-19 has tested businesses across all different industries and one thing we’ve taken note of is how essential it is to stay agile and adaptable during these times. The initial shock and panic that the onset of the pandemic sparked has begun to subside and a reimagined reality has now emerged.

Shrewd marketers and businesses are finding ways to make the best of this situation, by taking advantage of less competition in digital ad buy. Decreased cost-per-click and cost-per-conversion paired with an increase in online audience usage has created a unique opportunity for businesses to get ahead of competitors and increase ROI. Deciding on spending or pausing digital ad buy all comes down to identifying opportunities for a business specifically.

Getting more aggressive on ad buy, of course, means aiming to get more traffic to a website. Once that traffic comes in, we have our clients seal the deal by making sure their digital interactions are as seamless and effective as possible. Even if increasing digital ad buy turns out to not be the best plan of action for a business, or if the best option is actually to cut some budgets, reallocating our clients’ newly freed funds towards adapting their onsite assets has proven to be effective to staying proactive and setting the businesses up for success during and post COVID times. We’ve noted that a businesses’ ability to pivot, adapt and leverage the tools at their disposal is the best way to strategize a new plan for success.

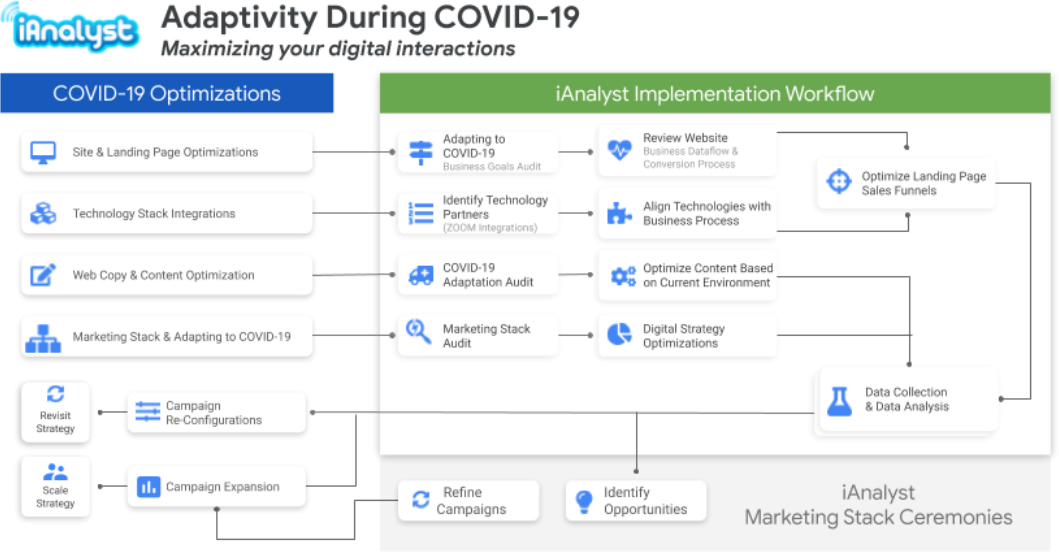

For years, we’ve been helping clients spanning a wide range of industries adapt to the times, overcome and work through any challenges they’ve faced and give them a new edge on their competition. Given the current circumstances, this is how we advise our clients and other businesses out there to optimize their marketing stacks and campaigns in ways that could give them an upper hand by implementing some of the following adjustments:

Website and Landing Page Optimizations

When running website and landing page optimizations for our clients, we start by helping them run a business goals audit. We work with them to help them examine where they’ve identified decreases in lead generation and revenue. We then identify where they can align available tools and assets with new conversion processes. We review the clients’ website, conducting a business dataflow assessment to help them optimize landing page sales funnels.

For example, in the current times, there is no need to throw a huge chunk of your budget out the window to revamp an entire site. Instead, opting to create a section, landing page or pop-up on how the company is handling COVID-19 could have just the right impact. Our clients have implemented this on their own websites, announcing new safety and cleanliness measures for brick and mortars, to updates on shipping times for e-commerce sites, to updates on wait times at customer call centers, and so on.

Creating clear calls to actions and appropriate conversion paths are crucial right now.

Technology Integrations

Next, it’s important to identify the right tech to help optimize conversion paths. Technology partners are more important now than they ever have been, since they help us create efficiency with day to day operations. From advanced work using the ZOOM API to convert client’s businesses and acclimate teams to a remote environment, to onsite food delivery optimization using OLO’s API, we continue to help our clients find innovative new ways to adapt to the current market. As a full-service marketing agency, we know what tools and technologies are available to suit our clients’ needs. We understand how to best leverage the tech for this new environment. The right partners can help businesses re-work their sales and support funnels, ultimately saving time and money.

Web Copy and Content Optimization

Adjusting web copy and content is also key to staying up to date with all that’s going on. A website’s copy should reflect any changes in how the organization is handling operations and conducting business. Having the right tone that speaks to the situation and adds value for audiences is also important to maintain the organization’s essence and brand reputation.

We start with a COVID-19 adaptation audit, identifying areas in a site’s web copy where mentioning the current state of affairs is relevant. We search for ways where our clients can provide value to their clients and audiences via pertinent, helpful information. Since search including COVID-19 issues and related terms is up at the moment, this also helps clients tap into the search traffic generated by these types of trending queries.

Marketing Stack & Adapting to COVID-19

Re-evaluating your current marketing program with your agency is crucial to realigning your strategy in the most successful way possible. With our clients, we run a marketing stack audit and identify what efforts can be doubled down on and where there is room to pull back and reallocate. This is done routinely with our clients to help them assess what is the best use of their marketing dollars each month, quarter and year. Making key digital strategy optimizations is always how we help them stay ahead of the curve time and time again.