Security Token ICOs and Compliance: Regulations A, D and Crowdfunding

One of the most contentious issues in the burgeoning token community is how governmental agencies will ultimately decide to regulate the sale and transfer of tokens, specifically with respect to initial coin offerings (ICOs). At present, financial experts continue to go back-and-forth on whether tokens should be treated as currencies, property assets, securities, or their own novel classification for governing purposes. Recent guidance from the SEC suggests that the organization may consider all tokens and offerings of tokens as securities and security offerings. To date, there has not been a clear example of a token offered in an ICO and subsequently traded that would make it through a compliance audit as a security. Understandably, many in the token community are worried by the prospect of security-based regulatory practices tempering the red-hot ICO market that raised a total of $6.3 billion in the first quarter of 2018 alone. However, this would be good news for proponents of token technologies as it would provide much needed clarity and structure to the wild west frontier known as the token economy. While securities regulations are continuously evolving, they have been in place and studied for hundreds of years with abundant data on the effects of different types of regulation. They are clearly defined and in recent years have become more flexible through the offering of registration exemptions which are tailored to alleviate the burdens to smaller businesses of complying with registration requirements. This article examines three registration exemptions that may emerge as promising paths to the successful completion of compliant ICOs.

Regulation A & Reg A+

Regulation A (“Reg A”) was adopted to decrease the burden to small companies of executing an equity offering while holding large company offerings to higher standards. It was subsequently amended as a part of the JOBS Act of 2012 in an effort to modernize the maximum raise limits and further relieve small offerings from certain disclosure requirements. There are two tiers of offerings addressed by Reg A which vary in the obligations placed upon the issuer, the investors included in the pool which is eligible to purchase securities sold in the offering, and the permitted marketing activities associated with the offering. Tier 1 allows companies to raise up to $20 million through the issuance of securities, while Tier 2 (or Reg A+) allows companies to raise up to $50 million. Both tiers allow issuers to market securities to any qualified investor as opposed to only accredited investors, do not automatically require ongoing reporting obligations once an offering is completed, and have a simplified registration form and process. Reg A offerings can be executed by domestic or Canadian issuers that are not subject to 1934 Act reporting requirements or disqualification under “bad actor” provisions of Rule 262. Companies that are not eligible to complete an offering under Reg A include investment companies, blank check companies, and issuers of oil, gas or mineral rights. Asset-backed securities also cannot be offered under Reg A. In recent years, there has been an increase in the number of firms utilizing registration exemptions provided in Reg A to raise capital and satisfy requirements to list on a public exchange. The first example of a company that used a Reg A+ raise to directly list to a major exchange was Myomo, which completed a $5 million raise before listing directly to the NYSE in 2017.

The Process

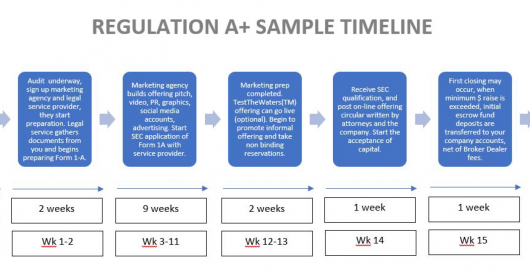

Raising capital by registering the sale of security tokens with the SEC under the Reg A exemption looks very similar to registering shares of stock in a company under the same exemption. The process for shares of stock or tokens is illustrated in the below diagram. While not as burdensome as a traditional public offering via S-1 registration statement, it still requires a meaningful investment of time and extensive up-front planning for successful execution.

The timeline for Reg A offerings can vary greatly depending on SEC turnaround time, the amount of time available to devote to the process, whether to include the optional “test the waters” step, and environmental factors. However, a reasonable duration to expect is around five to seven months. Once a Reg A offering is qualified by the SEC, it can continue as a live offering for 12 months, during which time it can be paused and reopened again at the discretion of the issuer.

Benefits of Regulation A Offerings

- Faster and cheaper than a conventional public offering which is not exempt from registration

- No ongoing reporting requirements

- Larger maximum raise amounts relative to other exempt public offerings

- Can sell to non-accredited investors as well as accredited investors

- Can be used to satisfy public exchange listing requirements

Drawbacks of Regulation A Offerings

- Longer period prior to initiating the offering than other exempt offerings

- Aggregate raise amounts are capped unlike registered offerings or certain other exempt offerings

- More robust disclosure requirements than certain other exempt offerings

- Not available for certain categories of issuers and types of securities

Regulation D

Regulation D (“Reg D”) was first adopted in 1982 to create an exemption from SEC registration for private placements by usually smaller companies. Reg D offerings are can be completed pursuant to Rule 504, 505, 506(b), or 506(c). Each rule has unique characteristics and restrictions, but the only one that allows general solicitation is Rule 506(c). This allowance only applies if all purchasers are accredited investors and the issuer takes reasonable steps to ensure that this is the case. There is neither a maximum raise amount nor a maximum number of shareholders for Reg D offerings relying on Rule 506(c). Issuers are not required to disclose financial or narrative information and are only required to provide a description of resale restrictions, an opportunity to receive certain other information, and an opportunity to ask questions. Securities issued under the Reg D Rule 506(c) exemption are classified as restricted securities.

The Process

The process to complete a Reg D offering relying on a Rule 506(c) exemption is fairly straightforward. The time required varies, but securities can begin to be marketed within about a month of beginning the process, and all forms and regulatory filings can be completed within about 45 to 60 days of starting. Unlike Reg A, the offering can continue until all securities authorized to be sold in the offering have been purchased.

As with any offering, the first step is to obtain legal advice and create a plan of attack. At this point, conversations should also begin with any relevant marketing partners. Once a legal service provider is engaged, they will prepare offering agreements and the placement memorandum. Simultaneously, engaged marketing service providers can prepare the marketing materials and strategy. When everything is ready to go, the offering can go live at the discretion of the issuer and the marketing campaign can begin. Any investments received will go into an escrow until it is verified that the pending investor is accredited, at which point the issuer can take the money from escrow. Within fifteen days of the sale of the first security in the offering, a Form D filing must be submitted to the SEC. Once complete, the issuer continues selling the securities authorized to be sold in the offering until fully sold or the offering is terminated.

Benefits of Regulation D Offerings

- Very fast and cheap compared to registered offerings and other exempt offerings

- Straightforward process with minimal disclosure requirements

- No SEC qualification requirement, which removes potentially extensive wait periods for SEC turnaround

- No maximum raise restrictions

- Offering timeline is at the issuer’s discretion

Drawbacks of Regulation D Offerings

- Only accredited investors can purchase securities in the offering

- Additional obligation of verifying investors’ accredited statuses prior to receiving funds

- Issuers cannot use the offering as a means of listing directly to a public exchange at completion

- Significant holding period for the restricted securities sold in the offering

Regulation Crowdfunding

Title III of the Jumpstart Our Business Startups (JOBS) Act of 2012 added Securities Act Section 4(a)(6) that provides an exemption from registration for certain crowdfunding transactions. In 2015, the SEC adopted Regulation Crowdfunding (Reg Crowdfunding) to implement the requirements of Title III. Reg Crowdfunding allows companies to raise up to an aggregate of $1,070,000 inclusive of any funds raised in the past twelve months under a Reg Crowdfunding registration exemption.

The Process

Each Reg Crowdfunding offering initiated by an issuer must be exclusively conducted through one online platform which must be operated by an intermediary which is approved for such activities by the SEC and FINRA. Issuers conducting Reg Crowdfunding offerings are required to file an offering statement on Form C prior to beginning the offering.

In terms of marketing the offering, the SEC has placed limitations on the nature of the materials. According to SEC guidance published on its website, “An issuer may not advertise the terms of a Regulation Crowdfunding offering except in a notice that directs investors to the intermediary’s platform and includes no more than the following information:

- a statement that the issuer is conducting an offering pursuant to Section 4(a)(6) of the Securities Act, the name of the intermediary through which the offering is being conducted, and a link directing the potential investor to the intermediary’s platform;

- the terms of the offering, which means the amount of securities offered, the nature of the securities, the price of the securities, and the closing date of the offering period; and

- factual information about the legal identity and business location of the issuer, limited to the name of the issuer of the security, the address, phone number, and website of the issuer, the e-mail address of a representative of the issuer, and a brief description of the business of the issuer.”

As the offering progresses, an issuer must either provide frequent updates on its progress toward raising its target amount via its offering platform or file Form C-U within 5 business days after reaching 50% and 100% of its target amount. If the issuer elects to raise more than the targeted amount indicated, then it must also file Form C-U to disclose the total amount of securities sold in the offering.

Finally, issuers may be subject to ongoing reporting requirements depending on their size, eligibility for exemptions from the requirements, or other factors. Every issuer should obtain a legal opinion from an attorney regarding which requirements apply to the issuer’s specific situation.

Benefits of Regulation Crowdfunding Offerings

- Non-accredited and accredited investors can purchase the securities sold in the offering

- Relatively few disclosure requirements

- Timing considerations are at the discretion of the issuer; as long as required forms are submitted within the times designated by the SEC, it just depends on the experience and resources available to the issuer

Drawbacks of Regulation Crowdfunding Offerings

- Very low maximum raise amount

- Requires identification and use of an approved online portal

- Restricts approved communications between the issuer and investors to only channels housed within the offering portal

- Strict limitations on permitted content for marketing materials

- Some prerequisite filings are required to meet disclosure requirements

Conclusion

The uncertainty surrounding the regulation of ICOs will likely linger for the immediate future, but the SEC has been making announcements providing more and more detail. Having a single, definitive set of rules would help to stabilize token markets and promote an equal playing field for all participants. Regulations that govern securities have been heavily studied and have generally been effective at protecting the investing public over the years. Relatively newer registration exemptions provide means of flexibility that avoid penalizing smaller issuers while protecting less sophisticated investors from being taken advantage of by unscrupulous issuers. Regulations A, D, and Crowdfunding are valuable resources that may allow issuers to complete compliant ICOs and alleviate fears of SEC action, bringing ICOs closer to the mainstream and making them safer for investors of all types.